Printing Smart: Navigating the Maze of Workplace Printer Leasing in addition to Financing

In today’s fast-paced enterprise environment, having typically the right office products is crucial regarding success. The selection between leasing and buying office printers and copiers could greatly impact your company’s efficiency, finances, and technological flexibility. With so numerous solutions, navigating the particular maze of printer leasing and funding may be daunting. On the other hand, understanding the benefits and even challenges associated together with each choice may help streamline your current decision-making process.

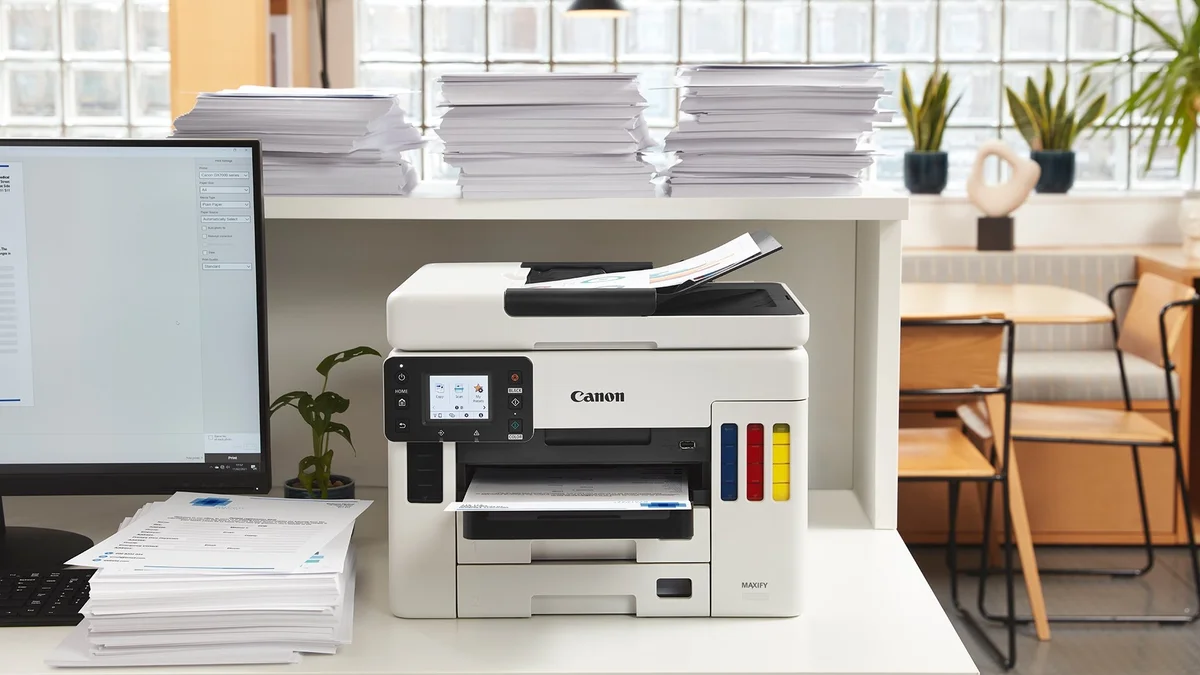

Leasing office printers and copiers is becoming increasingly popular among companies of all dimensions. Not only does it provide an additional flexible financial option, but it likewise allows companies in order to stay up-to-date together with the latest technology. Inside this article, we are going to explore the leading benefits of leasing, the particular key inquiries to question when choosing some sort of leasing company, plus why many small enterprises are opting for this kind of route. By typically the end, you will find a more clear understanding of how you can optimize your workplace equipment strategy and improve your business's efficiency while managing fees effectively.

Leasing vs. Acquiring: Evaluating Options

When contemplating office printers plus copiers, businesses generally face a major choice: should you rent or buy? Every single option has the distinct advantages in addition to drawbacks, which makes it important to evaluate exactly what aligns best with your company's objectives and financial situation. Buying can cause ownership plus potential long-term personal savings, but it often arrives with high straight up costs as well as the burden of depreciation. On the other hand, leasing offers even more flexibility but can produce ongoing payment obligations that some could find daunting over period.

Leasing office printers and copiers comes along with a host of advantages, particularly for growing businesses that will need to manage cashflow effectively. Leasing enables companies to obtain the latest technology without having an upfront money expenditure, giving them entry to state-of-the-art tools while preserving funds for other small business. Additionally, lease deals often include upkeep and support, ensuring that technology stays current and functional without a significant additional investment decision.

On the flip side, purchasing equipment can be a sound investment for businesses that require stableness and control above their assets. Nevertheless, potential hidden charges, such as maintenance as well as the expense regarding upgrading to new models, can reduce financial advantages. Assessing these factors will be crucial, as being the best choice will heavily influence operational performance, budget management, in addition to long-term planning the business.

Benefits of Procurment for Businesses

Leasing office computer printers and copiers presents significant advantages that can greatly benefit businesses coming from all dimensions. One of the particular primary benefits is the ability to be able to conserve cash stream. Instead of building a large upfront investment decision to acquire equipment, rental allows companies in order to spread the fees over time, releasing up capital intended for other critical regions of the business. This financial flexibility can easily be particularly beneficial for startups and smaller enterprises that may not have the resources to make investments heavily in technological innovation.

One other important benefit associated with leasing is entry to the latest technological innovation. The fast-paced developments in printing plus copying technology can quickly render more mature equipment obsolete. Having a lease, businesses may upgrade their ink jet printers and copiers more often, ensuring they have always the most successful and effective tools at their convenience. This not only enhances productivity nevertheless also improves the complete quality of work, as modern gadgets can have advanced functions that outdated models lack.

Leasing can likewise offer various tax benefits that enhance its appeal intended for businesses. In several cases, lease payments can be taken off as an enterprise expense, reducing taxable income and therefore lowering overall duty burdens. Furthermore, leasing often includes maintenance and support providers as part involving the package, reducing unexpected costs and allowing businesses in order to plan their budgets more effectively. This combination of financial cost savings and operational productivity makes leasing a new compelling option for many organizations.

Selecting the best Rental Agreement

When deciding on a lease contract agreement for office printers and copiers, it is essential to thoroughly evaluation the terms presented by different renting companies. Look intended for clarity on monthly payments, the size of typically the lease term, and even any potential fees that may arise during or in late the lease. Comprehending Click here for more of what exactly is included in the agreement, for instance preservation services and provides, can help a person avoid unexpected expenses later.

Another vital aspect to consider is the flexibility of typically the lease. Business requires can change speedily, so a lease contract that allows regarding upgrades or alterations may be highly valuable. Make certain that the contract provides options regarding early termination, upgrading to newer types, or switching to different equipment in case your business grows or changes direction. The right lease should accommodate your evolving requirements without imposing large penalties.

Lastly, examine typically the exit strategy defined in the rental agreement. Knowing just what happens at the end of typically the lease period is usually crucial for successful planning. Will an individual have the choice to purchase the equipment at the reduced rate, or will you want to return it? Additionally, consider how the end-of-lease options line-up with your business’s long-term strategies. A well-structured lease contract not merely meets your current needs although also supports your future growth and aims.